Calculate federal withholding per paycheck 2023

Subtract 12900 for Married otherwise. There are two main methods small businesses can use to calculate federal withholding tax.

2

Calculate Federal Income Tax FIT Withholding Amount.

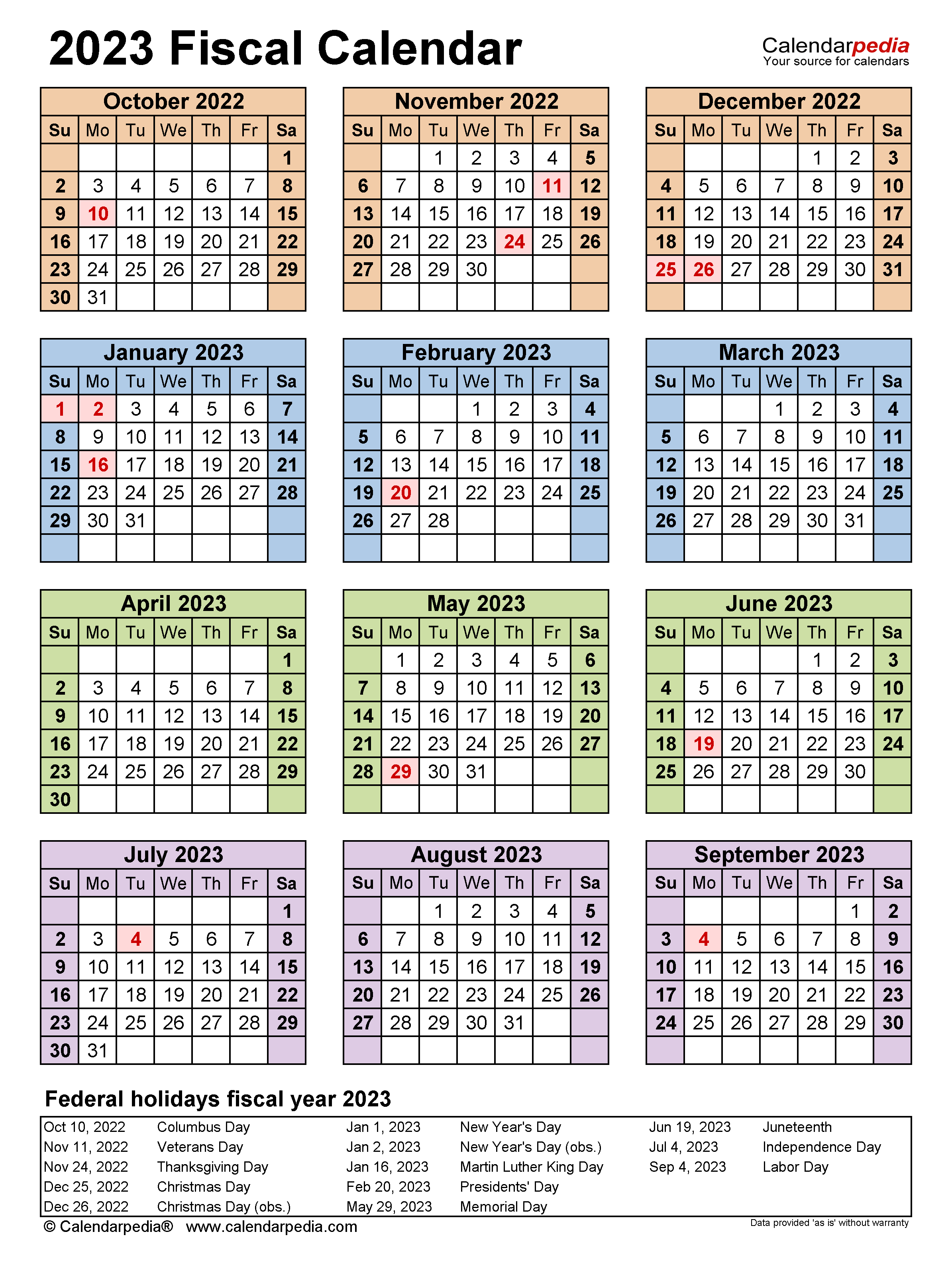

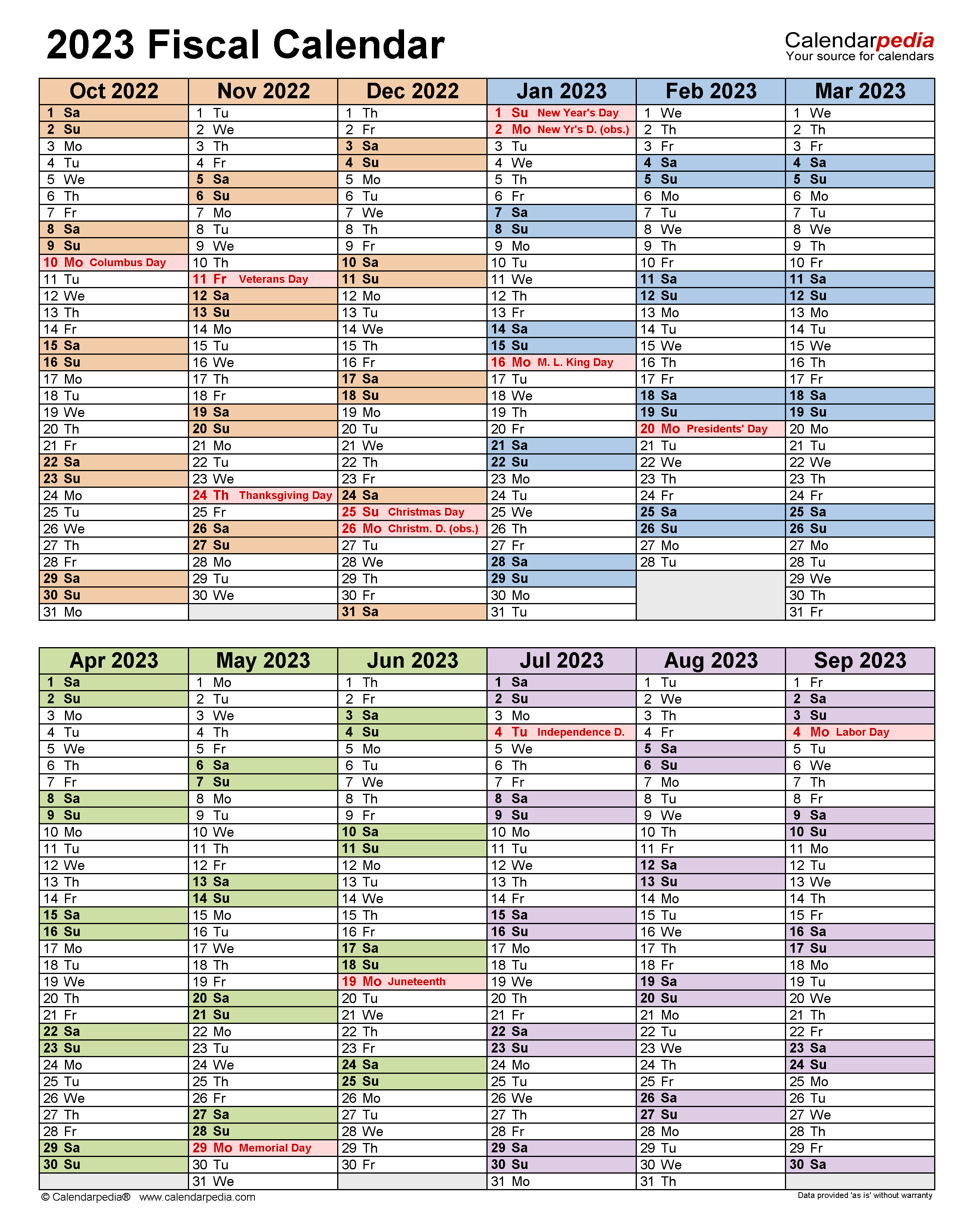

. FY 2023 Per Diem Rates apply from October 2022 - September 2023. It will be updated with 2023 tax year data as soon the data is available from the IRS. The employees adjusted gross.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of W-4 allowances. How to calculate annual income.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Enter your filing status income deductions and credits and we will estimate your total taxes.

250 and subtract the refund adjust amount from that. This Tax Return and Refund Estimator is currently based on 2022 tax tables. The wage bracket method and the percentage method.

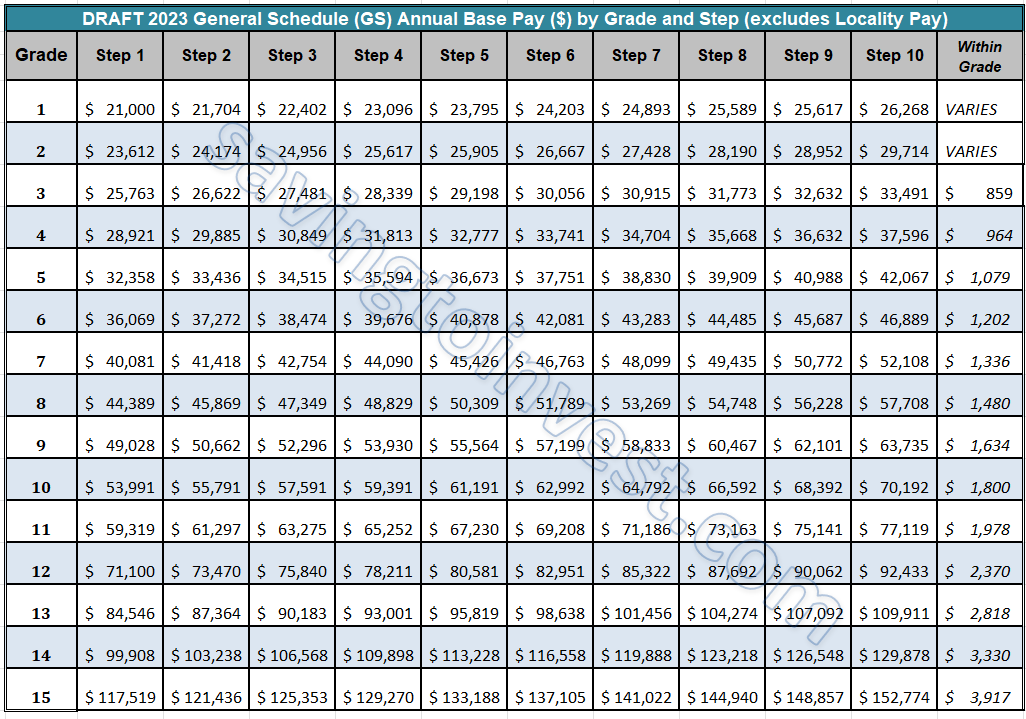

The result is net income. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Welcome to the FederalPay GS Pay Calculator.

250 minus 200 50. Then look at your last paychecks tax withholding amount eg. Ad Payroll So Easy You Can Set It Up Run It Yourself.

The General Schedule GS payscale is used to calculate the salaries for over 70 of all Federal government employees. Use this tool to. Prepare and e-File your.

It will be updated with 2023 tax year data as soon the data is available from the IRS. You can use the TurboTax W-4 withholding calculator to easily walk you through your withholding adjustments and help you fill out IRS Form W-4 Employee Withholding. 2022 Federal income tax withholding calculation.

Estimate your federal income tax withholding. That result is the tax withholding amount. Per-diems are fixed amounts to be used for lodging meals and incidental expenses when traveling on official.

IRS Tax Tip 2022-66 April 28 2022 All taxpayers should review their federal withholding each year to make sure theyre not having too little or too much tax withheld. How It Works. Our 2022 GS Pay.

This Tax Return and Refund Estimator is currently based on 2022 tax tables. We refer to the amount of wages taken from your paycheck. Once you have a better understanding how your 2022 taxes will work out plan accordingly.

All Services Backed by Tax Guarantee. This 2022 tax return and refund estimator provides you with detailed tax results during 2022. Based on your projected tax withholding for the year we can also estimate your tax refund or.

See how your refund take-home pay or tax due are affected by withholding amount. Prepare and e-File your. To calculate Federal Income Tax withholding you will need.

2023 Raise For 2022 Gs Federal Employee Pay Scale Latest Updates And News Aving To Invest

Federal Government Pay Period Calendar 2020 Period Calendar Payroll Calendar Calendar Printables

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Pay Scale Revised In Budget 2022 23 Chart Grade 1 To 21 Bise World Pakistani Education Entertainment Salary Increase Math Tutorials Salary

Estimated Income Tax Payments For 2022 And 2023 Pay Online

5 Printable Pay Stub Templates In Word Format Printablepaystub Stubtemplates Pintablepaystub Word Template Words Templates

Independent Contractor Pay Stub Template Payroll Template Fake Money Printable Payroll Checks

How To Pay Payroll Taxes A Step By Step Guide

Collin County College Calendar Collin County Calendar Board College

Social Security What Is The Wage Base For 2023 Gobankingrates

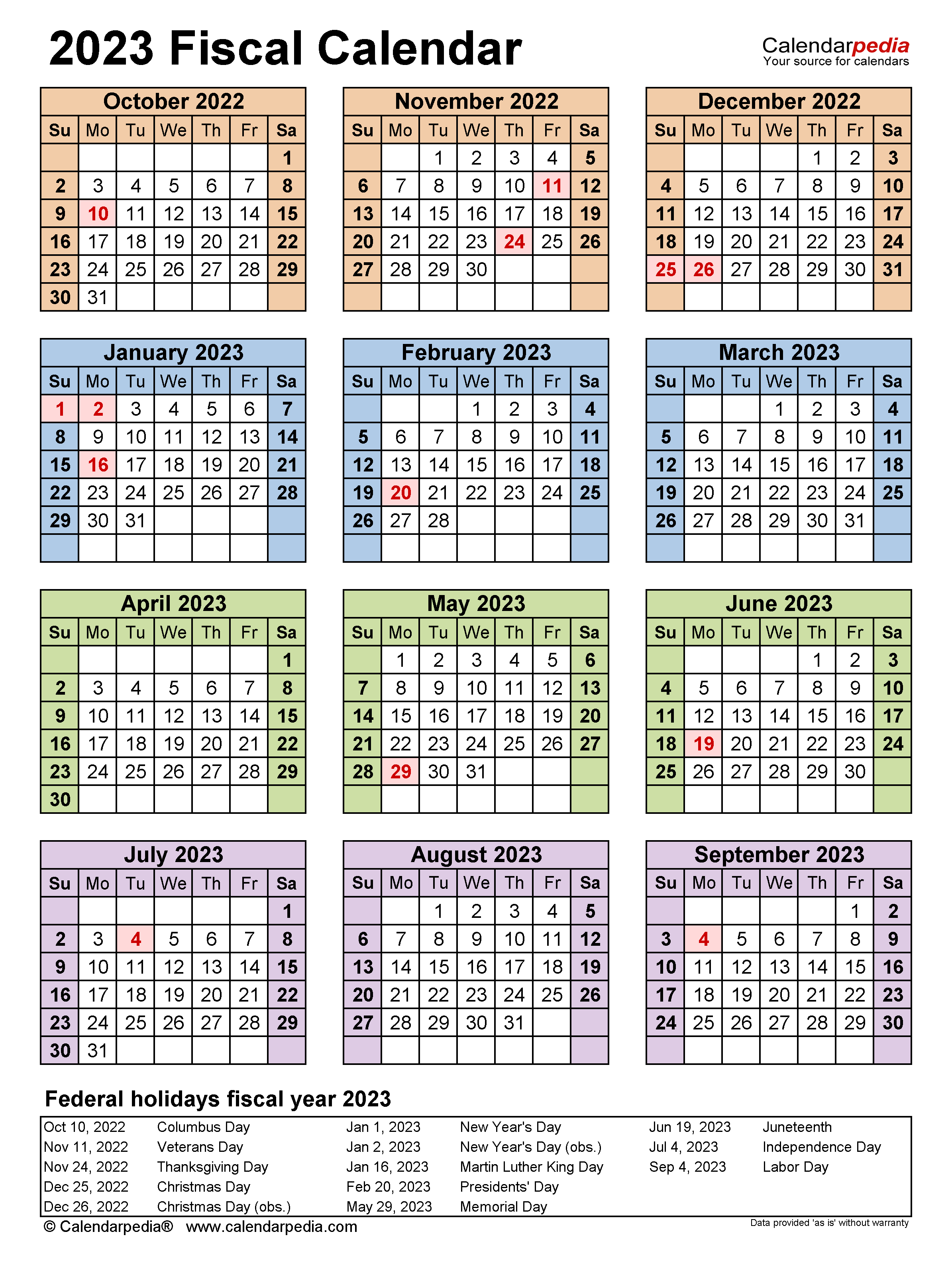

Fiscal Calendars 2023 Free Printable Pdf Templates

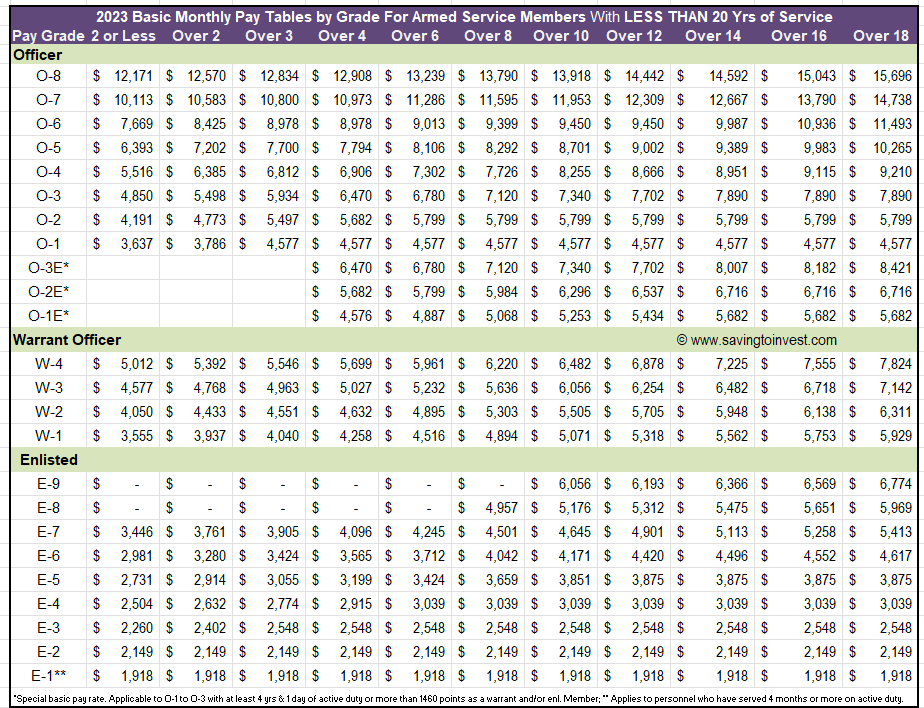

2023 Military Pay Chart 4 6 All Pay Grades

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

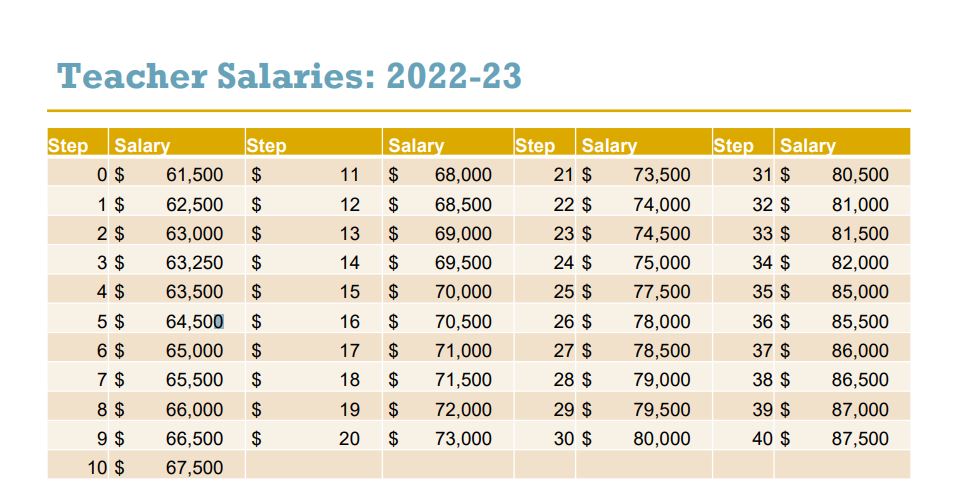

Hisd Trustees Unanimously Approve 2 2 Billion Budget And Highly Competitive Teacher Pay Raises News Blog

2023 Raise To 2022 Military Pay Charts Updated Monthly Basic Pay Tables For Armed Service Members Aving To Invest

Fiscal Calendars 2023 Free Printable Pdf Templates